Government support for anxious mortgage holders, but what support is available to your employees?

Blog

On 22 June 2023, the Bank of England (BoE) raised the base interest rate by half a point, bringing the benchmark rate to 5%. Ian Bird, Partner at Secondsight, explores the effect of further rate hikes for mortgage holders, with a particular focus on what the government is doing to help those employees who might be struggling to meet higher costs of repayments.

The BoE has increased interest rates 13 times in a row

The latest hike is the 13th consecutive interest rate rise since December 2021. The base interest rate is now at its highest level since April 2008.

We’ve seen successive rate rises because the base rate is the main tool the BoE can use to help tackle inflation. Typically, higher interest rates mean people tend to spend less on goods and services, which helps to balance out consumer demand and slow down inflation.

Although higher interest rates represent good news for savers, millions of mortgage holders face rising repayments, the Institute for Fiscal Studies (IFS) has warned. Around 25% of mortgages are expected to come to the end of a fixed-term deal between now and the last quarter of 2023.

The report also revealed that:

- 60% of mortgage holders (8.5 million people) are set to spend more than a fifth of their incomes on mortgage payments.

- The biggest financial burden will fall on households in London and the south-east of England, where property prices tend to be higher than the national average.

- The biggest rise is set to hurt those in their 30s, who could see payments jump by £360 a month, or 11% of disposable income.

The effect of the increased base rate on mortgage repayments

The Evening Standard report that, in London alone, more than 100,000 fixed-rate loans are due to expire by the end of 2023. At which time, mortgage holders will be forced into loans that mean they must pay more interest on their repayments.

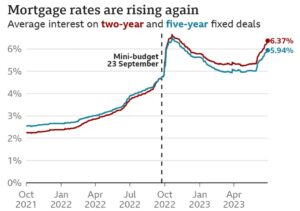

As shown in the below chart, the average rate on a two-year fixed loan has increased from 6.3% in May to 6.37%. The average fixed rate on a five-year deal was 5.91% in May and this has increased to 5.94%.

Source: BBC News

These rising rates have fuelled concern that more borrowers will struggle to meet potential mortgage hikes. As a result, there has been a great deal of pressure on the government to step in and support struggling homeowners.

The government recognise it’s a worrying time for many mortgage holders, so what support can you offer your employees during these challenging times?

Following a recent meeting with lenders and the Financial Conduct Authority (FCA), chancellor Jeremy Hunt unveiled a series of new measures to help protect mortgage holders who find themselves struggling to meet increased monthly mortgage repayments.

The new mortgage charter provides support for residential mortgage customers, and includes several important commitments, some of which may be useful for your employees:

- People who are worried about their mortgage repayments can call their lender for information and support, without any impact on their credit score.

- Customers won’t be forced to have their homes repossessed within 12 months from their first missed payment.

- Customers nearing the end of a fixed-rate deal will be offered the chance to lock in a deal up to six months ahead of their current deal ending. They will also be able to apply for a better deal right up until their new term starts, if one is available.

- A new agreement between lenders, the FCA, and the government permits customers to switch to an interest-only mortgage for six months or extend their mortgage term to reduce their monthly payments and switch back to their original term within the first six months if they choose to. Both options can be taken with no need for a new affordability check and won’t affect their credit score.

- Support for customers who are up to date with payments to switch to a new mortgage deal at the end of their existing fixed rate deal without another affordability check.

- Provide well-timed information to help customers plan ahead should their current rate be due to end.

- Offer tailored support for anyone struggling and deploy highly trained staff to help customers. This could mean extending their term to reduce their payments, offering a switch to interest only payments, but also a range of other options such as a temporary payment deferral or part interest-part repayment. The right option will depend on the customer’s circumstances.

While this is a good start, more needs to be done to address the root causes of inflation to keep costs and mortgage rates down.

In these difficult financial times, seeking good mortgage advice is crucial

With interest rates rising, seeking good mortgage advice from a professional adviser is more important than ever. And, this could be a good first step to supporting your employees during these challenging times.

An expert adviser can:

Provide expert guidance

An independent mortgage adviser will understand the intricacies of the market and give your employees valuable insight into their options. As well as helping to demystify the jargon, their extensive knowledge of how lenders work can help your employees make informed decisions that align with their long-term financial goals.

Assess affordability and budgeting

Rising interest rates could affect your employees’ affordability and budgeting plans more than they may think. A professional adviser can provide your employees with a clearer understanding of how their financial situation might affect their chances of obtaining an appropriate mortgage at a price they can afford.

An adviser can also help analyse their income, expenses, and debt, considering various interest rate scenarios, enabling your employees to establish a realistic budget and understand the financial implications of different mortgage options.

Access to a whole range of lenders and products

Independent mortgage advisers have access to an extensive network of lenders and a broad range of mortgage products. As interest rates rise and the mortgage market becomes more competitive and complex, an independent adviser is well-placed to help find a suitable mortgage solution to match your employee’s needs.

Buying a home is a long-term investment that should be considered as part of your employees’ overall financial plan

A professional mortgage adviser can help your employees to:

- Align their mortgage strategy with their broader financial goals

- Understand the effect of rising interest rates on their financial stability

- Recommend appropriate strategies to mitigate risks.

Combined, each of these areas can help your employees to make well-informed decisions that align with their short-term and long-term objectives.

Get in touch

In a rising interest rate environment, professional advice is invaluable. Independent mortgage advisers can provide the knowledge and tools necessary to make informed decisions that protect your employees’ financial wellbeing, as well as ensuring they are receiving the necessary support.

If you have any questions about anything you’ve read here or elsewhere in the news, please don’t hesitate to get in touch.

Email info@second-sight.com or call us on 0330 332 7143.

Please note

This blog is for general information only and does not constitute advice.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Think carefully before securing other debts against your home.