Sticky inflation and rising interest rates: How to support financially stressed employees

Blog

Ian Bird, Partner at Secondsight highlights in his latest blog the financial difficulties many of us are facing with the rise in interest rates and inflation.

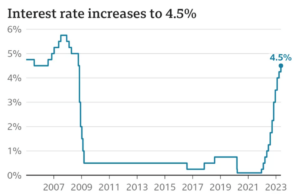

The Bank of England (BoE) has raised interest rates 12 times in a row. With the latest rise of 0.25% announced on Thursday 11 May, we have seen the base interest rate increase from just 0.5% in February 2022 to 4.5% in May 2023.

The chart below shows the steep rise in interest rates we’ve seen over the last year.

Source: BBC

Following many years of low interest, some people may now be struggling to manage their finances in unfamiliar territory.

Why high inflation has led to the rise in interest rates

The base interest rate is the main tool the Bank of England can use to help combat inflation. When inflation starts to rise too much, interest rates are increased as this helps deal with one of the main drivers of inflation: consumer demand. This is because higher interest rates can help encourage people to save their money instead of spending it on goods.

Inflation is the rising cost of goods and services and is measured by the Consumer Prices Index (CPI), which looks at the price of a “basket” of more than 700 goods and services compared with the previous year.

The last few years have resembled a chain of falling dominos, with one problem triggering the next. The Covid pandemic, the war in Ukraine, and rising energy costs have all contributed to the persistent inflation we are experiencing.

Today, UK inflation remains close to its highest level for 40 years and is not dropping as quickly as many experts had hoped. Meanwhile, prices in UK supermarkets remain high. According to data from Which?, food inflation fell slightly – from 17.2% in March to 17.1% in April.

Meanwhile, the rate of inflation in the UK, as of March 2023, was 10.1%. As a result, the Bank of England has been forced to increase interest rates in a bid to return inflation to their target rate of 2%.

Due to the sticky inflation problem and persistently high food prices, interest rates are unlikely to drop until we see a change in inflation.

Read on to find out what this means for you and your employees and how you can provide support to reassure employees who may be facing tricky financial times.

2 key ways increasing interest rates can affect people’s finances

The amount you earn on your savings could rise

While high street banks don’t have to increase the interest they pay to savers in line with the Bank of England base rate, many do in the hope of attracting more savers.

On 15 May 2023, according to Moneyfacts, the best interest rate on an easy access savings account was 3.71%.

This is good news but it’s important to note that while inflation remains in double figures, it’s unlikely that the interest earned on your cash savings will outpace it. A financial planner can help you understand ways in which you could inflation-proof your wealth over the long term.

Mortgage and loan repayments could rise

The rising base rate means it costs more for people to borrow. As a result, mortgage and loan repayments could become more expensive.

Whether your mortgage or loan rate will go up as a result of the latest base rate hike depends on the type of deal you have.

While most tracker- and variable-rate loans will move in line with the base rate, fixed-rate mortgages and loans will only change price when the fixed term comes to an end.

If any of your employees have been subject to increased repayments for their mortgage or loans or are about to reach the end of a fixed-term period, they could be feeling some concern about how they will continue to afford the payments.

Understandably, this could increase stress levels, which may affect their performance at work.

Poor financial wellbeing and money troubles can affect employees’ mental health

Persistent inflation and rising interest rates are all tied up with the cost of living crisis. The current difficult economic times could contribute to increased financial pressure for employees, with many struggling to afford to keep on top of their bills and maintain their lifestyles.

Some employees may be finding it difficult to pay for basic necessities such as housing, utilities, and transport, as well as having to reduce the amount they spend on leisure activities. This can have a negative effect on their mental wellbeing and have a detrimental impact on workplace productivity.

Supporting employees’ financial wellbeing is always important and, with this week being Mental Health Awareness week, now is a great time to make sure you’re taking steps to help and reassure your staff wherever possible.

Among the many ways Secondsight can help deliver workplace benefits to your employees, our popular financial education programme could be an ideal solution to provide easily accessible support and reassurance.

For those struggling in the current difficult economic circumstances we can help educate your team about budgeting and saving, as well as understanding the mortgage market. We can also explain some positive actions they could take to manage their finances and reduce any potential stress they may be feeling about their money or future financial situation.

Get in touch

If you want to know more about how you can help your employees to feel more confident about their finances, please get in touch.

Email info@second-sight.com or call us on 0330 332 7143.

Please note

This blog is for general information only and does not constitute advice. Your home or property may be repossessed if you do not keep up repayments on your mortgage.

Secondsight is a trading name of Foster Denovo Limited, which is authorised and regulated by the Financial Conduct Authority.

Information correct at time of publishing, 23rd May 2023