How to support your employees as they navigate an increasingly cashless society

Blog

Digital transactions are becoming the norm in so many areas of life. From buying a bus ticket to paying for your meal using a restaurant’s app, there are now very few places where you might need to carry cash to pay for something.

Following such a rapid transition to digital payments, some people are predicting that cash could one day become obsolete.

While online, card, or contactless payments can be convenient, a move away from cash entirely could have serious implications for lots of people. Ian Bird, Partner at Secondsight, explores how you can support employees who may have concerns or difficulties arising from the increasingly cashless nature of transactions.

Experts predict that, by 2031, just 6% of UK transactions will be paid using cash

While there are no plans for the UK to become an entirely cashless society, people are using notes and coins less frequently than they used to.

Figures reported by UK Finance show that cash was still the second most commonly used payment method in 2021, making up 15% of all transactions. But its popularity is falling rapidly. The report found that there were 23.1 million people who only used cash once a month or never in 2021, compared to 13.7 million in 2020.

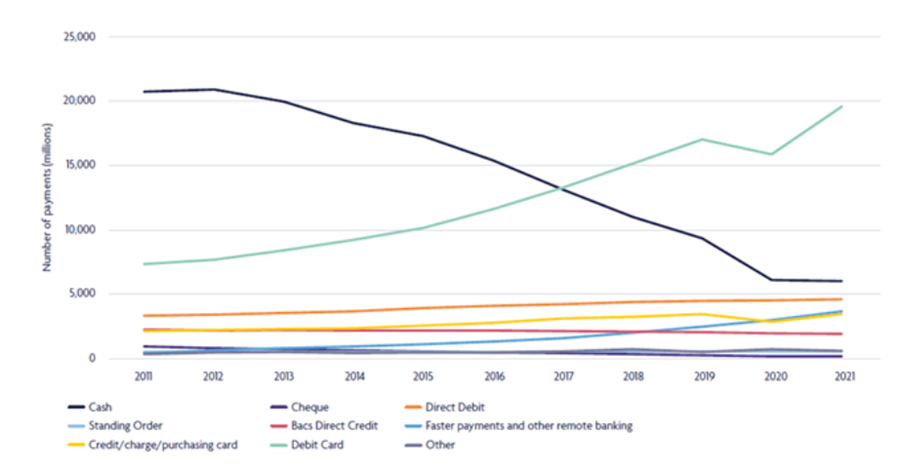

The chart below shows the sharp decline in cash payments since 2011.

Source: UK Finance

Another survey that UK Finance commissioned in 2022 found that there had been a further drop in people using cash infrequently. The results showed that, in 2018, 1 in 4 people were using cash every two to three days. By 2022 this number had dropped to 1 in 10.

Based on their findings in 2021, UK Finance considers it highly unlikely that cash will become obsolete any time soon. That said, their experts have predicted that by 2031 only 6% of transactions will be paid using cash.

A cashless society could prove challenging for many people

If you’ve ever experienced a faulty card machine that just won’t connect while you’re trying to pay a bill, you’ll understand why a cashless society can sometimes prove challenging. But for many, not being able to use cash is more than a minor inconvenience.

In fact, it’s likely that at least some of your employees may fall into the following groups that find digital transactions especially tricky.

People with concerns about online safety

For some people, new technologies can feel especially daunting because of concerns about the safety of online payments. For example, they may fear that by using these new payment methods, they could become a target for scammers.

This can cause them to avoid scenarios where they are unable to use cash to pay for goods or services.

People who use cash to help them budget more effectively

Cash can be a helpful way to keep to a budget because you can withdraw a finite amount of cash from your account to spend each week or month.

This Is Money reports that 2 in 5 people are more likely to use cash to help them budget since the cost of living crisis began.

Those on lower incomes were much more likely to turn to cash to help stick to budget. Almost half of people earning less than £20,000 a year were more likely to use cash as prices rise, compared to 1 in 5 of those earning £50,000 or above.

People who use cash to avoid debt

In a broader sense, cash can be a helpful way to avoid or manage debt.

Cashless payment methods including contactless card payments, digital wallets, and online banking can take time to adjust to. It can be easy to accidentally overspend when it’s so quick and easy to tap your card compared to physically handing over cash.

This means that for some, it can be all too easy to find yourself spending above your means and building up debts. By using cash for payments, some people could find it easier to maintain a healthy level of spending, increasing their financial wellbeing.

Helping your employees to access support in managing their finances online

Money worries, including the difficulties that cashless payments can create for your employees, can have a detrimental effect on an individual’s mental health and emotional wellbeing. Over time, this can harm their performance at work.

As a result, supporting your team with their concerns is an important part of employee wellbeing.

There are a few ways you could do this:

- Encourage your team members to speak to someone if they’re worried about money.

- Create a safe space so that they can feel comfortable raising their concerns.

- Offer informal training sessions to help those who are struggling feel more confident about managing their money online.

- Create educational webinars that can be circulated across your organisation about how to stay safe while managing your money online.

- Provide resources that can help with budgeting and debt management.

Ultimately, by encouraging conversations about money and ensuring that your employees feel supported, you can help everyone to feel more confident about managing their finances and using new payment methods.

Get in touch

If you’d like to learn more about how you can support your employees with their financial wellbeing, we can help.

Email info@second-sight.com or call us on 0330 332 7143.

Please note

This blog is for general information only and does not constitute advice.

Secondsight is a trading name of Foster Denovo Limited, which is authorised and regulated by the Financial Conduct Authority.

Information correct as of 2nd October 2023.